Central KYC Registry Process 2026 (CKYC Form) Apply! at ckycindia.in, Here, you can check the latest news regarding the Budget 2026, at the time of the announcement of Budget 2026, Finance Minister Nirmala Sitharaman presented the Union Budget for the 2026 session. In this budget, they news rules and regulations such as Insurance, Pensions, BIT. The time budget brings relief from the middle class, which has no tax deduction under the 12 lakh income per annum. Now the government announced related to the Central KYC Registry Process also. The mandatory and simple process is also be available soon on the official website for the general people. The CKYC Registry 2026-26 simplification process will soon be released. You have checked the details of the registration process. What is CKYC is, its benefits, documents required, etc.

Central KYC Registry Process 2026

| Title details | Central KYC Registry Process 2026 |

| Beneficiaries Details | Indian Citizens & Financial Services |

| Department | Finance Ministry of India |

| Registry process | Coming soon |

| Purpose of CKYC | To centralize the KYC Database |

| Official website | ckycindia.in |

The Central Know Your Customer (CKYC) is a government initiative aimed at simplifying and standardizing KYC compliance across financial institutions. CKYC helps individuals avoid the repetitive submission of KYC documents when opening accounts with banks, mutual funds, insurance companies, and Non-Banking Financial Companies (NBFCs).

With a centralized database of customer KYC information, CKYC enhances security, efficiency, and convenience. In 2026, the Indian government is set to roll out an updated Central KYC Registry system to further streamline the process, making it easier for both customers and financial institutions.

What is CKYC

Central KYC (CKYC) is a centralized repository managed by the Central Registry of Securitization Asset Reconstruction and Security Interest of India (CERSAI). The primary purpose of CKYC is to create a uniform and single KYC process for financial institutions, eliminating the need for multiple KYC submissions.

YSR Rythu Bharosa Payment Status

Madhu Babu Pension Yojana

Once you complete the CKYC process, you receive a unique 14-digit CKYC number. This number allows financial institutions to access your KYC details from the CKYC database, reducing paperwork and making transactions smoother.

Key Benefits of CKYC

- One-Time KYC Submission: No need to submit documents repeatedly for different financial services.

- Faster Transactions: CKYC enables real-time verification and account opening.

- Inter-usability: The same KYC record can be used across banks, insurance companies, and NBFCs.

- Secure Data Storage: KYC information is stored digitally and verified with issuing authorities.

- Regulatory Compliance: CKYC ensures adherence to financial regulations and reduces fraud risks.

Features of Central KYC

| Feature | Description |

|---|---|

| Unique 14-digit CKYC Number | A unique number linked to your identity proof for easy verification. |

| Electronic Data Storage | Customer KYC details are stored in a secure digital format. |

| Verification with Issuing Authorities | Documents submitted for KYC are cross-verified with the issuing agencies. |

| Automatic Update Notifications | Any changes to KYC details are notified to financial institutions. |

| Real-Time Account Opening | Financial institutions can instantly verify CKYC-compliant customers. |

| Secure Authentication | CKYC has advanced security measures to prevent unauthorized access. |

| Inter-Institution Usability | KYC data can be used across multiple financial services without resubmitting documents. |

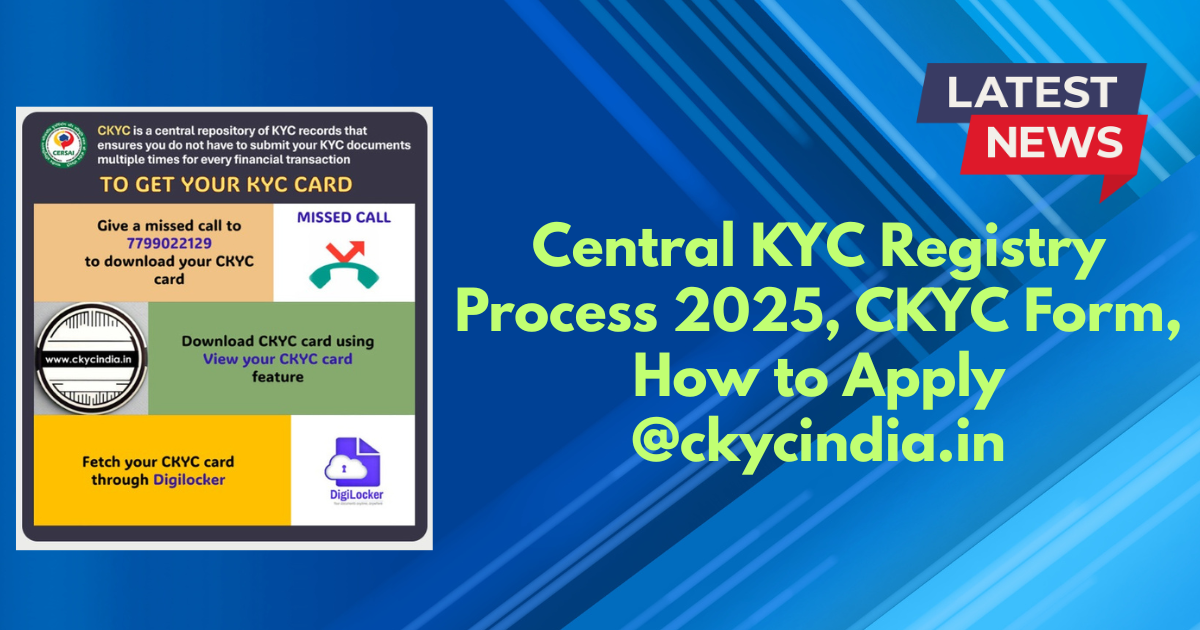

Central KYC Card Download

After the registration process, you get the registration number and other details for KYC Registry. Then you have to check the status and how to download your card online. Its simple you have to log in official website and check the issued link to download your card online.

The CKYC is mandatory …? Yes it is mandatory for to get a contact centralized database of your KYC information to the financial sector and avoid further kyc registration in another place.

Documents Required

To complete the CKYC process, you need to submit the following documents –

- Proof of Identity (POI) – Aadhaar Card, PAN Card, Voter ID, Passport, Driving License, NREGA Job Card

- Proof of Address (POA) – Aadhaar Card, Passport, Voter ID, Utility Bills (Electricity, Water, Gas)

- Passport Size Photograph

- Signature Specimen, These documents must be submitted in physical or digital format as per the requirements of the financial institution.

Types of CKYC Accounts

There are four types of CKYC accounts, each identified by a specific prefix in the CKYC number:

| CKYC Account Type | Description | Identifier Prefix |

|---|---|---|

| Normal Account | Opened when submitting PAN, Aadhaar, Voter ID, Passport, Driving License, or NREGA Job Card. | No Prefix |

| Simplified Measures Account | Opened when submitting other valid documents as per RBI regulations. | L |

| Small Account | Opened with only personal details and a photograph (without full documents). | S |

| OTP-Based eKYC Account | Opened using Aadhaar eKYC via OTP authentication. | O |

How to Complete the Central KYC Process

To apply for CKYC in 2026, follow these simple steps –

Step 1: Find a Participating Financial Institution

- Banks, mutual funds, insurance companies, and NBFCs registered with CKYC can help complete your CKYC process.

Step 2: Fill the CKYC Form

- Visit the official CKYC website (ckycindia.in) or collect the form from a financial institution.

- Provide personal details like name, date of birth, PAN/Aadhaar, and contact information.

Step 3: Submit Required Documents

- Attach copies of your Proof of Identity (POI), Proof of Address (POA), passport-size photo, and signature specimen.

Step 4: Verification Process

- The financial institution will verify your documents with the respective authorities.

Step 5: Receive Your CKYC Number

- Once verified, you will receive a unique 14-digit CKYC number via email or SMS.

How to Check Your Central KYC Registry

You can check your CKYC number by following these steps –

- Visit the CKYC check portal (ckycindia.in)

- Enter your PAN number in the designated field.

- Solve the CAPTCHA/security code displayed.

- Your CKYC details, including your 14-digit CKYC number, will be displayed.

- Download your CKYC report (if available).

Upcoming Changes in Central KYC

The Indian government is introducing major updates to the CKYC process in 2026 as part of a broader digital transformation initiative.

The new system will Enhance user experience by simplifying the KYC process. Introduce a more efficient mechanism for periodic KYC updates. They reduce paperwork and delays in financial transactions. It ensures better regulatory compliance while maintaining security. These changes aim to make CKYC more seamless and efficient for both individuals and financial institutions.

Official Page – OTRFORM